Already signed up to the course? Click here to log in.

As GPs ourselves, we know how little you get taught about running your GP business, which is why we started this course.

The Medics’ Money GP Partnership course will set you up for a happy, profitable and rewarding career as a GP partner, whether you are a new partner or have been a partner for many years.

We will teach you the essential financial and business aspects of being a GP partner such as understanding the accounts and the key financial metrics that will increase profitability and deliver the best care to your patients.

We will also cover the equally important topics of how to manage your workload, looking after your own health and wellbeing so you can be the best GP Partner you can be whilst also being the best mother, father, husband, wife, partner and doctor that you can be.

The Medics’ Money GP Partnership course will set you up for a happy, profitable and rewarding career as a partner.

Already signed up to the course? Click here to log in.

If I said you could make £55,000 without doing any extra work, you’d probably cry “SCAM”, and you’d be right.

The ’SCAM’ is that as GP partners we are not given ANY business training, yet we are expected to run a multi-million pound business (GP Practices) and left to learn business “on the job”. This = small mistakes, and in a business turning over several million pounds, small mistakes cost a LOT of money.

Here’s a message I got from a partner on our partnership course recently:

“Hi Tommy, Just saw this today. Thanks you very much for this lovely course. Getting on very well and learning so much. We have realised after the last 2 sessions that we hadn’t claimed income worth £55k which we are now going to be paid in January which is excellent news.”

This £55k was claimed without doing any EXTRA work. It was combination of reclaiming business rates, some tax tweaks and tightening up on LCS claims using a spreadsheet we built for partners on our course.

And that’s the biggest mistake we see partners making – doing work but not being paid for it. In most businesses getting paid is easy, you do the work and then you get paid. Unfortunately, as partners, getting paid often involves convoluted claims processes, which are easy to get wrong. Each year we have to tick off a tedious list of mandatory training, like reminders not to use water on an electrical fire. But we get no mandatory BUSINESS training: that’s why we started the Medics’ Money Partnership Course.

As GPs ourselves, and with Tommy a GP Partner, we know how tight cash flow is so we allow you to secure your place with a £300 deposit.

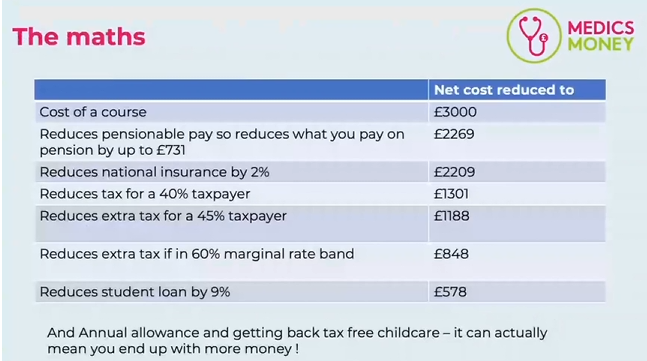

The total cost of the course is £2,500 +VAT = £3,000 total.

If you are a new partner and eligible for New to Partnership funding then our course is approved for this BUT if you are NOT eligible there are other NHS funding options ….

The 2023/24 PCN DES outlines a Leadership and management payment worth (worth £20,500 to a typical PCN with 30,000 patients) and many previous participants on our course have used this funding.

Page 65 of the PCN DES Contract specification 2023-24 outlines more detail: https://www.england.nhs.uk/publication/network-contract-des-contract-specification-for-2023-24-pcn-requirements-and-entitlements/

NHS England provides service development funding (sometimes called system development funding) to each ICB as additional funding to support PCNs. The funding is to support workforce programmes with many ICBs using it to fund training for partners, some of whom have used it for our course.

Apply now and we will give you more details on funding.

💰If you are self funding the net cost of the course is just £1,188 for a 45% taxpayer and £848 for a 60% taxpayer. If you split the cost amongst a typical 5 partner practice it would cost each partner just £170 net to send one individual on our course.

For those that became partners after April 2021 and before 31 March 2023 and subject to eligibility criteria, the New to Partnership funding can cover the entire cost of our course. Further details below.

If you are using the New to Partnership funding here’s some specifics to be aware of

Some specifics to be aware of for those using the NHS New to GP Partnership funding:

To make use of the funding, you need to have become a partner prior to 31 March 2023 and have applied for the New to Partnership scheme by 30 June 2023.

The NHS will only approve training that commenced after you have become a partner.

Training must start within the first year of accepting a partnership role/receiving your welcome letter, unless otherwise agreed with NHSEI

Financial claims should be submitted via NHSEI within three months of purchasing the training. Full details for claiming reimbursement will be shared through the welcome letter sent to successful applicants.

You (or your practice) must pay the full amount, i.e. the NHS does not pay this for you. Instead, the NHS will reimburse you the full amount 1 year from the date you signed the partnership agreement or one year from the date of your New to Partnership funding letter.

We will issue an invoice for the remainder of the £3,000 shortly after you’ve paid your deposit. In order to qualify for reimbursement the NHS insists that you claim within three months of this invoice date. Once you have made payment, we will issue a receipt. Page 8 “business training” in this document gives further details. NHS Guidance.

No our course is for ALL partners. Many experienced partners join our course as they take on extra business responsibility eg they become the senior partner or the finance partner. Non GP partners are especially welcome and we have Practice Managers, Physios, Pharmacists, Paramedics and Nurse partners on our course.

Click “How much does the course cost” FAQ to learn how the NHS can fully fund our course and “Apply now” and we can support you in getting funding.

The next cohort starts on 30th April 2025👇

As GPs ourselves we know how busy life is so don’t worry if you can’t make the live sessions – the replays are available to watch anytime and you can ask the experts questions anytime in our exclusive online community with 700 other partners and over 20 experts who teach on the course

Please note all core course sessions run from 9am-12pm, unless otherwise stated, and run on:

| Wednesday 30 April 25 |

| Tuesday 03 June 25 |

| Wednesday 2 July 25 |

| Tuesday 9 September 25 |

| Tuesday 14 October 25 |

| Wednesday 5 November 25 |

| Tuesday 7 January 26 |

| Wednesday 25 February 26 |

| Tuesday 21 April 26 |

All dates are subject to session leaders’ availability, and as such could be subject to change.

We host 1 hour bonus sessions throughout the year. These are optional and include:

🥊Managing conflict – Dr Claire Sieber is a GP mediator and tells us how to manage disputes.

💰Get paid for work you already do – getting paid for work you do is important and PA items are an area where some GPs lose a lot of money. The experts show you how to avoid this.

💻Ardens – Dr Kamal (founder of Ardens) tells us how to maximise this powerful software to improve patient care and make sure you get paid

💊Dispensing masterclass – the core course content covers dispensing but what about some tips and tricks from experts who’ve been dispensing for years.

📈Investing – with inflation destroying returns on cash, investing is increasingly important. In this bonus session we show you how to get started with investing in equities

⛑ Protecting your most valuable asset – YOU. Locum insurance, who needs it? Life insurance – who needs it? Let our experts give you unbiased, independent advice.

🤷♂️Managing your team and HR issues – How to lead a team and avoid HR pitfalls. A longer session(1.5 hours) but so important.

As GPs ourselves, and with Tommy a GP Partner, we know how tight cash flow is so we allow you to secure your place with a £300 deposit.

The total cost of the course is £2,500 +VAT = £3,000 total.

If you are a new partner and eligible for New to Partnership funding then our course is approved for this BUT if you are NOT eligible there are other NHS funding options ….

The 2024/25 PCN DES incorporates a Leadership and management payment into the Core PCN funding. Historically it was worth £20,500 to a typical PCN with 30,000 patients in prior years and many previous participants on our course have used this funding.

Use this funding proposal to support your application

https://www.medicsmoney.co.uk/

Page 58 of the PCN DES Contract specification 2024-25 outlines more detail: https://www.england.

NHS England provides service development funding (sometimes called system development funding) to each ICB as additional funding to support PCNs. The funding is to support workforce programmes with many ICBs using it to fund training for partners, some of whom have used it for our course.

Apply now and we will give you more details on funding.

💰If you are self funding the net cost of the course is just £1,188 for a 45% taxpayer and £848 for a 60% taxpayer. If you split the cost amongst a typical 5 partner practice it would cost each partner just £170 net to send one individual on our course.

For those that became partners after April 2021 and before 31 March 2023 and subject to eligibility criteria, the New to Partnership funding can cover the entire cost of our course. Further details below.

If you are using the New to Partnership funding here’s some specifics to be aware of

Some specifics to be aware of for those using the NHS New to GP Partnership funding:

To make use of the funding, you need to have become a partner prior to 31 March 2023 and have applied for the New to Partnership scheme by 30 June 2023.

The NHS will only approve training that commenced after you have become a partner.

Training must start within the first year of accepting a partnership role/receiving your welcome letter, unless otherwise agreed with NHSEI

Financial claims should be submitted via NHSEI within three months of purchasing the training. Full details for claiming reimbursement will be shared through the welcome letter sent to successful applicants.

You (or your practice) must pay the full amount, i.e. the NHS does not pay this for you. Instead, the NHS will reimburse you the full amount 1 year from the date you signed the partnership agreement or one year from the date of your New to Partnership funding letter.

We will issue an invoice for the remainder of the £3,000 shortly after you’ve paid your deposit. In order to qualify for reimbursement the NHS insists that you claim within three months of this invoice date. Once you have made payment, we will issue a receipt. Page 8 “business training” in this document gives further details. NHS Guidance.

ANY partners in GP practices who want to learn the non-clinical skills you need to thrive in your role as a partner. This includes GP Partners, Nurse Partners, Practice Manager Partners, Pharmacist Partners, Physio Partners.

Places are limited and are filling up fast. If you are interested press the ‘Apply Now’ button below and we will get back to you.

The course will be held in our interactive online community. There will be live teaching sessions and recorded sessions. The online community will allow you to interact with us and other participants, ask questions of the experts and access additional material whenever is convenient for you.

As GP partners ourselves, we know how busy life can be. All the live teaching will be available to watch as a replay and our online community allows you to ask questions as you go along.

Our faculty includes GP Partners, Specialist Medical Accountants, Specialist Medical Financials adviser, Lawyers who specialise in GPs, GP Property experts, GP wellness coaches and practice managers. Medics’ Money is unique in that we have all the best advisers available, so you get the very best information from leaders in their fields.

We’ve distilled all the essential knowledge you need to thrive in your new role and recruited the best experts to teach you.

Already signed up to the course? Click here to log in.

Read this video to understand how you can learn and save at the same time by signing up to the Medic’s Money GP Partnership Course.

Places are limited and are filling up fast. If you are interested complete the form below and we will get back to you.

Find out more about the GP Partnership Course from two of the presenters, Dr Hussain Gandhi and Dr Tommy Perkins.

Watch the video below to find out more information about the course and how it could help you.

I’m Ed and I’m not only a GP, but also a Chartered Accountant and Chartered Tax adviser. This unique skillset allows us to deliver the very best financial training to my GP colleagues. I specialise in Tax issues and have recently adopted two rescue cats.

I’m Tommy and I’ve been a GP Partner for several years now. As cofounder of Medics’ Money I’ve learnt so much from Ed and the other experts at Medics Money which helped me settle into my partnership. I want all new partners to get the benefit of this expertise so we set up the Medics’ Money New to GP Partnership course. In my spare time I enjoy spending time with my family and surfing waves.

I’m Andy Pow and I have over 20 years’ experience in medical accounting. My specialist areas include appraising the performance of GP practices, changes in GP structures, and the NHS pension scheme. I’m also a board member of the Association of Independent Medical Accountants(AISMA) and a leading commentator on healthcare issues. In my spare time I enjoy hill walking in the lake district with my wife, who is a GP.

I’m Andrew Burwood and I have over 20 years’ experience as a specialist medical accountant. I am well-known throughout the region for my pro-active advice and personal approach. In my spare time I enjoy spending time with my young family, keeping fit (when time permits!) and supporting Norwich City.

I’m Rob Day and I specialise in regulatory and commercial advice to those working within the primary care sector. Within this field I have particular expertise when it comes to supporting those seeking to acquire, sell or merge GP practices, establish joint ventures or otherwise work at scale. In my spare time I enjoy all sports, particularly football and cricket.

I’m Lizzy Lloyd and I have over 20 years’ experience as a medical accountant and I look after GP medical practices; from sole practitioners to super surgeries, Primary Care Networks, hospital consultants with their own private practice, locum GPs and GP federations. I am a member of the AISMA (Association of Independent Medical Accountants) board.

I’m Ian Crompton. I worked for Lloyds Bank for 43 years, set up their (award winning) HealthCare Team in 2004 and was Head of HealthCare there until I left in 2019. I now run a business focussed on primary care finance, particularly for doctors, and get involved in partner buy-ins, surgery refinance and developments. Away from the business I play golf and tennis in the summer and ski as much as I can in the winter.

Imagine if you could meet up with fellow partners, learn the latest tips from the best GP business experts out there AND have fun in London.

In October 2022 and November 2023 we invited members of our exclusive Partnership course to London.

Would anyone come? Would it be useful? Could learning about the business of GP ever be fun?

Here’s the answer… ➡️

Subject to demand, we’ll be running the Live session this year too.

This pre-course assessment gives you an idea of what the course covers. Don’t worry if you answer mostly 1-2’s, by the end of the course you will be 4-5’s