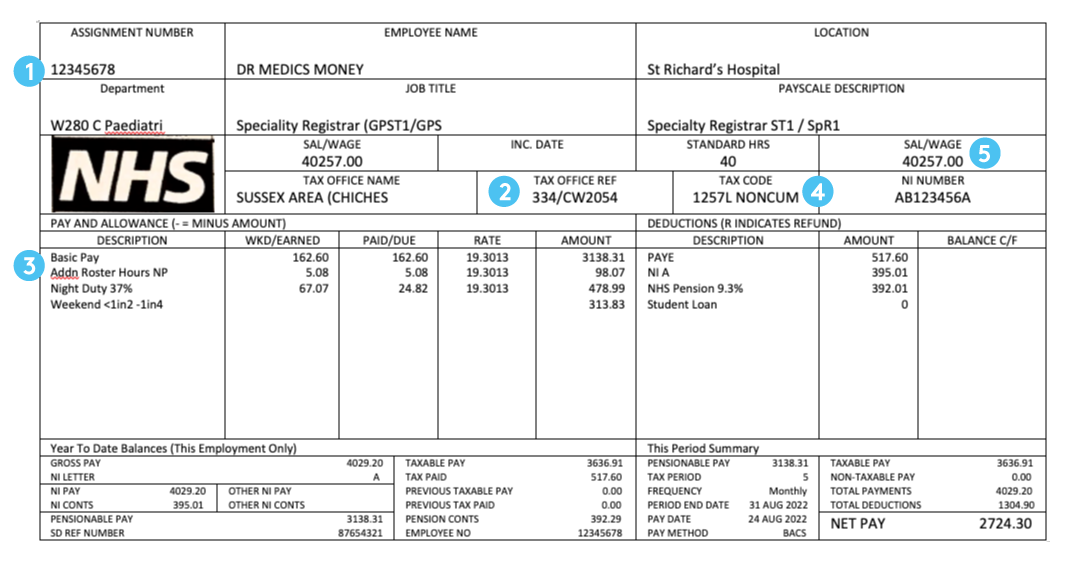

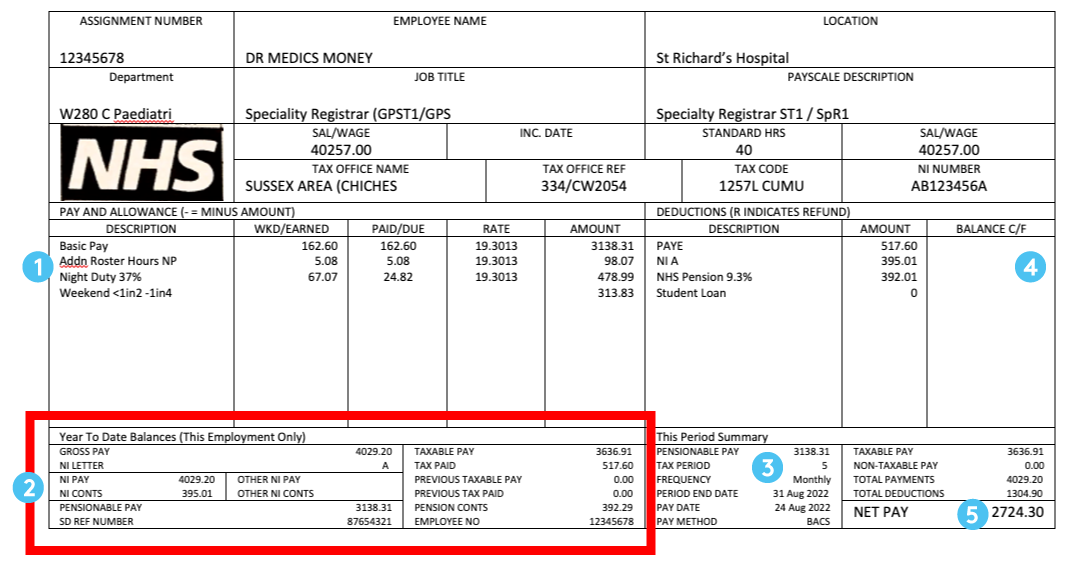

We frequently get requests for help regarding understanding the mysteries of Doctors’payslips. While there is significant variation between the payslips that doctors receive, the below should hopefully give some basic understanding of what is shown on your payslip.

The example given gives a payslip under the 2016 Junior Doctor contract using a Payslip that Ed received on his Paediatric Rotation (updated for the relevant tax numbers).

- This is your employment number or payroll number

- This is your employer’s PAYE reference with HMRC. This is very important and will be needed if you claim expenses using a Personal Tax Account or if you complete a Self-Assessment Tax return. number or payroll number

- These figures give your gross pay for the month. The figures shown here are:

- Basic pay: one-twelfth of your basic salary for the year.

- Addn Roster Hours NP gives your monthly pay for any additional hours in the month above the 40 standard hours.

- Night Duty 37% is the pay for any hours receiving an enhanced rate of 37% of your hourly basic pay

- Weekend allowance is the amount you are paid for working weekends based on the number of weekends per month you work ranging from 1 in 8 to 1 in 2

- This is your tax code. Note that in this example the doctor is getting all of his personal allowance £12,570 but that this figure should be higher to reflect professional expenses that attract tax relief.Click here to understand more about your tax code.

- This is your basic salary for the year, the “nodal pay point” for your grade

What medical school didn’t teach us about money

“What medical school didn’t teach us about money” will give doctors a step by step plan to transforming your financial future. Enter your details to download your copy now

- Not shown here but your payslip may also include a payment for being non-resident on call which should be 8% of your basic salary, any flexible pay premia e.g. for GP trainees, emergency medicine etc and any cash floor protection you receive after transitioning from the old to the new contract. These should be included in this section if applicable – for example a trainee psychiatrist would see “Flex Pay Psych Core” here.

- These figures show the totals for the tax year (but only from the Trust paying the salary showed on the payslip).

- This number represents the month of the tax year with 1 being April and 12 being March. If you have been at the same trust for the whole tax year, tax period 12 should be the same as on your P60.

- The amounts on the right show the amount of tax (taken via the Pay As You Earn or PAYE system) and your National Insurance (NI) contribution.They also show the amount taken for your NHS pension (the amount of which depends on your gross salary) and any Student Loan contributions for the month.

- This is your net pay and hence the amount that will actual be paid into your bank account.

Join 30,000 doctors and receive free, exclusive, financial CPD for doctors in your inbox.

Medics’ Money is run by doctors and finance experts, for doctors. Our free financial CPD gives you all the knowledge you need to take control of your finances.