You’ve worked hard to earn your money. Investing that money can help make your money work for you, growing over time and giving you the financial freedom to buy a house, send your kids to private school or retire early and travel the world. Investing can be intimidating, conjuring up images of men in red braces reading the Financial Times frantically buying and selling shares.

Now I’m not going to tell you about a how to make a million pounds trading shares and retire by Friday. If you’re expecting us to give you get rich quick schemes or tips on individual shares to invest in, you’re going to be disappointed. If getting rich quick is very hard, the good news is getting wealthy slowly is not particularly hard, but it takes commitment, discipline, knowledge and probably advice.

Why invest?

This is personal to you. Maybe you’re saving up to send the children to private school or for a house. Perhaps like me you want the financial freedom to choose when and where you work. Unless you want to earn every penny of your wealth at the coalface being a doctor until you reach retirement, you need an alternative income and investing could be it.

It’s important to consider timeframes here. Anything less than 5 years is a very short time frame for investing and as we’ll see later, the longer you invest for the less the risk.

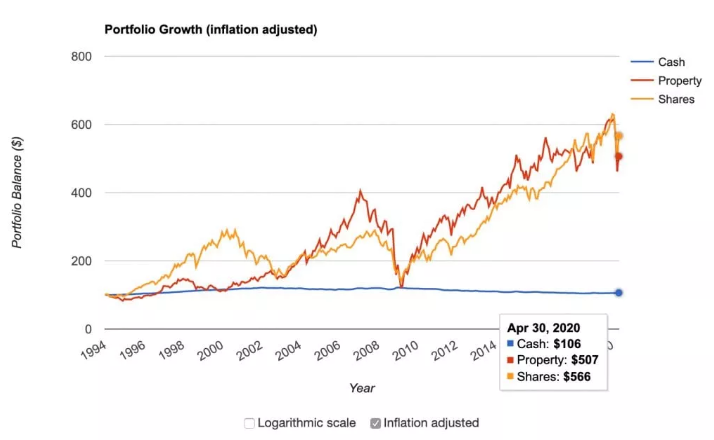

Here’s a graph that shows how the inflation adjusted returns of $100 invested in 1994. Source https://www.portfoliovisualizer.com.

As you can see in that timeframe property and shares have significantly outperformed cash.

Not convinced?

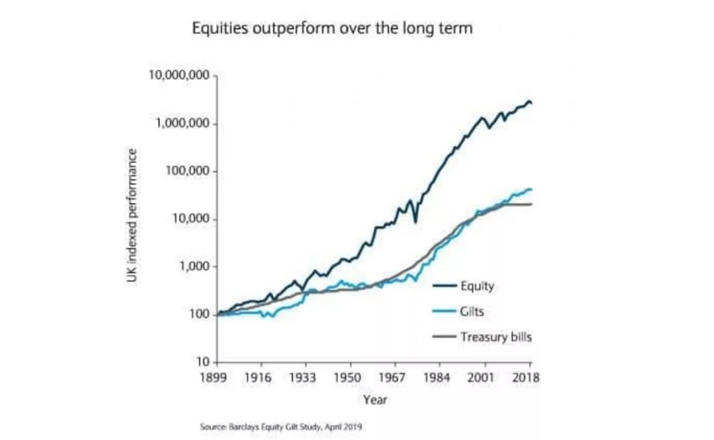

Well here’s another graph that shows the performance of £100 invested in 1899 in three different asset classes. Again it shows favourable performance for equities (see definitions below) and less favourable for cash.

Source https://privatebank.barclays.com/news-and-insights/2019/july/market-perspectives/market-counts/

Now you’ll see why my children don’t have piggybanks to save cash, but do have Junior Stocks and Shares ISAs holding a well-diversified, low cost portfolio.

Start early to maximise compound interest

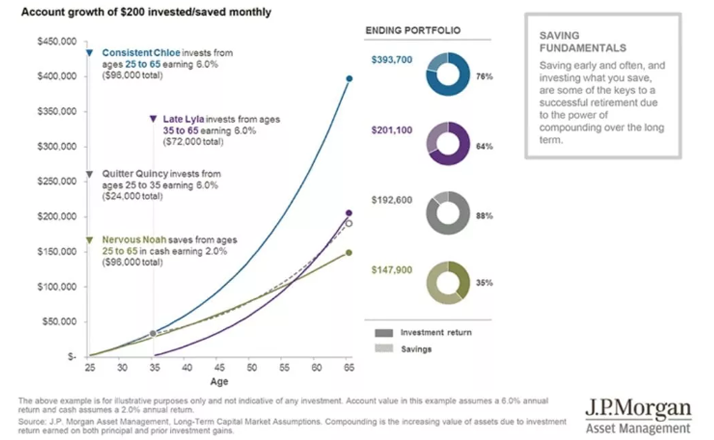

Here’s a graph every doctor needs to see. It compares 4 people who invest $200 monthly.

As you can see starting early makes a big difference to the outcome due to compound interest.

Source https://am.jpmorgan.com/us/en/asset-management/gim/per/insights/guide-to-retirement

If you are young enough (25) to be “Consistent Chloe” that’s great, start now. We wish we could have started investing earlier but medical school debt put pay to that. More likely you’ll be “Late Lyla” and pay close attention to “Nervous Noah” who kept all his money in cash. Nervous Noah is the reason why we can’t just leave all our investments in cash.

In a rush to get started?

Listen to this podcast on how to get started with investing.

Definitions

Like medicine there’s a confusing vocabulary around investing that once you learn can help to demystify what is essentially a simple concept – give some of your money to someone else and at the end they might give you back more, or less than you gave them at the start.

Shares – (stocks, equities) are units of a company that can be bought and sold and the value of the share fluctuates

Bonds – are a way of loaning money to the organisation issuing the bond, usually a government or a company. It’s effectively an IOU between the investor and whoever issued the bond. In the UK government issued bonds are called gilts, in the US they are called T-Bills.

Commodities – are physical assets such as precious metals, like gold, energy, like oil, or even agricultural assets like grain.

Funds – (Funds, Exchange traded funds, Investment trusts) are ways to buy a selection of investments. These can be actively managed by a fund manager who picks and chooses investments or passively managed, which simply track the performance of the market they are tracking.

So where to start?

Invest tax efficiently

The good news is investing tax efficiently is very easy thanks to Individual Savings Account (ISA). There are many forms of ISAs, including Cash ISAs, Stocks and Shares ISAs, Lifetime ISA and Innovative finance ISA. They say life begins at 40, but unfortunately your eligibility for a Lifetime ISA ends at 40. So, if you are approaching 40 you might want to look into LISA sooner rather than later.

Understand risk

Risk in relation to investing can be complex. The risk you’re probably most worried about with investment is investment risk, the risk you lose some or all of your money. But there’s also inflation risk – the risk that like Nervous Noah in the chart above you hold your wealth in cash and it is value is effectively reduced by inflation. Generally, the higher the risk, the greater the potential return. Understanding your own appetite for risk is essential to getting the correct investments for you. If you get your appetite for risk wrong, the first time your investments go down, you will panic.

Buy high, sell low is a recipe for losing money.

A good financial adviser will include a detailed assessment of your risk as part of your investment plan.

- Reduce risk

- Diversification

- Time in the market

- Pound cost averaging

- Asset allocation

Holding a wide range of investments for a longer timeframe is a proven way to mitigate risk. Buying individual shares is extremely risky and a poor strategy for the amateur investor. Whilst you may get lucky occasionally, we are looking for consistent returns over a very long time and being consistently lucky is not a reliable investment strategy. Investing in funds provide an easy way to invest in many shares and diversify and mitigate some of that risk.

Pound cost averaging is another way to reduce risk. Instead of saving up £1,200 in cash then investing in a lump sum once a year, pound cost averaging means you would invest £100 a month over 12 months. In some situations, this can help to smooth out market volatility and reduce risk.

Another key part of reducing risk is the asset allocation in your portfolio. Asset allocation describes how you split your investments amongst the various asset classes, cash, shares, bonds and property. Matching asset allocation to your risk and your goals is essential and something that a good financial adviser will help you with. If you are young, investing for the long term and happy to take significant risk, you might hold a portfolio mostly in equities (higher risk). As you get older you may be less tolerant of risk and therefore hold more bonds (lower risk) An oft quoted rule of thumb is:

% of stocks in portfolio = 100 – age

So, for a 60-year-old they might hold 40% in equities.

Risk is a massive subject and understanding your tolerance for it and how you will mitigate it is essential for successful investing.

What medical school didn’t teach us about money

“What medical school didn’t teach us about money” will give doctors a step by step plan to transforming your financial future. Enter your details to download your copy now

Minimise costs

Minimising costs is essential for successful investor. If you want to see what a 1% difference in costs looks like over a 30 year investment, have a play around with the compound interest calculator I mentioned in week 3. The costs of investing come from 4 areas

Fund costs

Active funds (see definitions) use experienced managers to try and pick the best investments. Despite this a majority, but not all, active funds still underperform the passive tracker funds, especially when taking into account the higher fees charged by active funds.

Platform costs

You will buy and hold your investments through a platform. These platforms charge varying fees for holding your investments. Research the costs carefully and be aware that the costs of holding the same fund can vary significantly depending on the platform.

Advice costs

At Medics’ Money we believe in good advice for the right price. Not only do we only recommend advisers that fulfil our rigorous criteria for quality, but we also only recommend advisers that charge fair and transparent fees for advice.

But what is a fair price? Well the average fee that Medics’ Money advisers charge for setting up your investments is 3% of the investment amount. Some offer a fixed fee for larger or smaller amounts. If you want the adviser to look after your investments long term the ongoing management charges are around 1%, with most significantly lower than this. If you have a large portfolio, you should expect a reduction in the % fees. None of the advisers on Medics’ Money charge any exit fees.

We are often approached by advisers who want to join Medics’ Money who charge extortionate fees for investments. Reasons to justify the high fees are numerous, but often include they have access to a “special range of funds that have superior returns”. None of them has ever provided evidence to support this claim and no adviser charging extortionate fees will ever be allowed to join Medics’ Money.

I have friends who happily pay £25 per week for a cleaner (£1,300 per year), but don’t want to pay a financial adviser £1,000 per year to manage their portfolio. I don’t pay for a cleaner, but I do have an adviser to oversee my investments. Which brings me to the final cost, your time. If you are going to manage your own investments, you are going to need to allocate significant time to doing so. For busy, high income, professionals like doctors, its highly likely that our time would be best spent earning money being a doctor or enjoying some downtime. As long as the advice you are paying for is the right advice, for a fair price.

Should I get advice?

If I give a stockbroker a stethoscope, they don’t become a doctor. If doctors are given a share trading account, they don’t become stockbrokers. Take advice from qualified individuals.

There’s nothing stopping you from opening a stocks and shares ISA right now and buying shares or funds. There’s also a wealth of information on the internet that could allow you to educate yourself on investing. You could invest in a well-diversified, low cost portfolio in a tax efficient wrapper like a stocks and shares ISA for 30 years and probably achieve reasonable returns. At Medics’ Money we encourage you to take control of your own finances and provide the resources to enable you to do this wherever possible. But for the vast majority of doctors looking to invest, it is our belief they would be better off taking professional advice. Unless you want to dedicate significant time to researching investing properly, the risks of poor returns, or even worse loss are significant. Research has shown that using an adviser can add up to 3% to returns. Interestingly these gains were largely realised by behaviour management and encouraging clients to stick to the plan. Source https://www.vanguard.co.uk/professional/adviser-support/advisers-alpha

Join 30,000 doctors and receive free, exclusive, financial CPD for doctors in your inbox.

Medics’ Money is run by doctors and finance experts, for doctors. Our free financial CPD gives you all the knowledge you need to take control of your finances.