You will already know that the main income tax rates in the England, Wales, and Northern Ireland are 20%, 40% and 45% depending on your income. In Scotland, the main income tax rates 19%, 20%, 21%, 42%, 45% and 48%. These are the absolute tax rates but these may not necessarily be your marginal tax rate which is a very important concept that all doctors need to understand.

The marginal tax rate is the percentage of tax paid on earnings for the next pound earned. So if a doctor in London has a salary of, say, £70,000 and earns an extra pound, they will pay 40% or 40 pence of this extra pound in tax – the absolute rate and marginal rate are the same here. Simple enough…. But there are some situations where the marginal rate is different.

The most common way in which the marginal rate becomes important for doctors is essentially when the doctor earns more than £100,000 in income. Once you get over this threshold your marginal tax rate may be higher than you expect. Where an individual’s adjusted net income exceeds £100,000 in 2025/26, the personal allowance will be reduced by one half of the excess income above £100,000. Adjusted net income is simply net income reduced by the gross amount of any gift aid payments or personal pension contributions eligible for relief in the tax year. Note your NHS pension will already have been taken into account in arriving at your net income; also those employment expenses that you can claim a tax deduction for will also reduce your net income making it even more important to maximise your claim.

Essentially then, over £100,000 of adjusted net income the government begin to claw back your tax-free personal allowance. This was part of the measures introduced by the Labour Government to help tackle the large government debts incurred during the 2008 Financial Crisis.

For every two pounds you go over £100,000 you lose one pound of your personal allowance. So, by the time an individual has an adjusted net income of £125,140 or more in the current 2025/26 tax year they lose the benefit of the personal allowance entirely. This means that your marginal tax rate is not 40% but 60% between £100,000 and £125,140.

As an example, imagine a doctor in London earns £100,000 net income in the 2024/25 tax year and that this is increased to £105,000 for the 2025/26 tax year. Her personal allowance was £12,570 in the 2024/25 tax year but in the new tax year her personal allowance will be reduced by £1 for every £2 over £100,000 i.e. by £2,500. Her personal allowance will no longer be £12,570 but £12,570 less £2,500 = £10,070 and for every one pound of additional income she has received her marginal tax rate is 60% (i.e. she keeps 40 pence in every pound of this increase.)

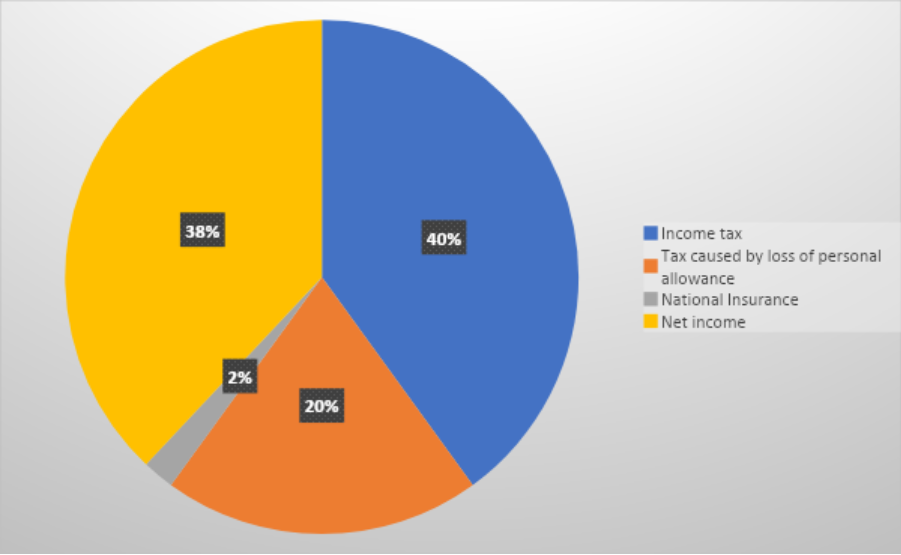

As an illustration, imagine earning £100,000; if you receive an extra £1 of income this is where it will go:

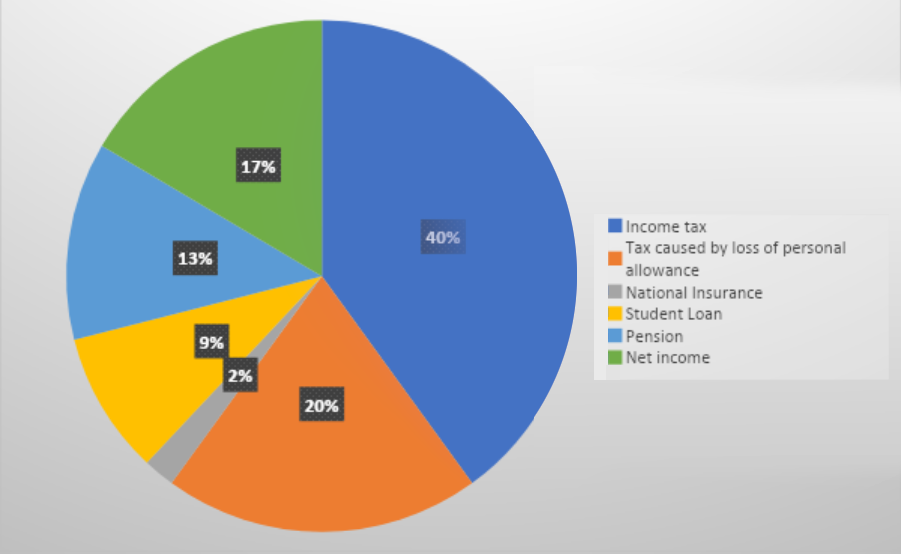

If we include the student loan (9%) and the pension contribution (assumed to be 12.5%) it looks like this:

So, if you earnt £100 only £16.50 would be paid into your bank account.

The Tax-Free Childcare Scheme

There’s another sting when you reach £100,000 if you have children. Over this amount you lose any entitlement to the Tax-Free childcare scheme. This is a government scheme where you get up to £500 every three months, up to £2,000 a year, for each of your children to help with the costs of childcare (more if your child is disabled). If you or your partner earn more than £100,000 of net adjusted income you lose your entitlement to the scheme.

In terms of losing your personal allowance or the benefits of the Tax-Free childcare scheme note that we have talked about adjusted net income not earnings. Your net income includes your employment earnings, and these can be reduced by claiming your employment expenses so another reason to make sure you claim them. Further adjustments to get to net income include deducting any grossed-up donations to charities on which you claim Gift Aid and any private pension contributions you make. As we have already said your NHS pension will already be taken into account. The point is that if your income hovers around the £100,000 mark you may want to make sure you are claiming all allowable professional expenses and consider making charitable donations or further pension contributions to bring your net income below £100,000 (though be very careful regarding making additional pension contributions!!!).

What medical school didn’t teach us about money

“What medical school didn’t teach us about money” will give doctors a step by step plan to transforming your financial future. Enter your details to download your copy now

The High-Income Child Benefit Charge

Child benefit is a weekly, tax-free, amount that UK individuals can claim for their children and it can be claimed by anyone whatever they earn. There is a higher amount of £25.60 a week for the eldest child and £16.95 a week for each of the other children.

The high-income child benefit charge is a mechanism by which the government claws back the child benefit once the “adjusted net income” of either the claimant or their partner exceeds £60,000. The charge is 1% of the child benefit for every £200 of adjusted net income in excess of £60,000 (rounded to the nearest whole number). Once an individual (or their partner) reaches £80,000 of adjusted net income the full child benefit that has been claimed will be taken by the government. Note that the charge is never higher than the amount of child benefit received and rests with whichever partner has the higher income. That person will need to file a Self-Assessment Tax Return to repay the child benefit. “Adjusted net income” is defined as above.

Taxpayers are allowed to elect not to receive the benefit which will then prevent anyone with income in excess of £60,000 from claiming child benefit only to then have to repay it back (this election can always be revoked later.)

Readers will note that there is an inherent unfairness with the high-income child benefit charge because it is based on the income of one of the partners, not the combined income. That means that if there are two partners each earning £60,000 the household will be able to claim the full child benefit and not have to repay anything and yet a household with one partner earning £80,000 will have all child benefit clawed back. It is another situation where it is important to reduce net income where possible, such as by maximising claims for employment expenses, potentially making additional pension payments (with the same caveat as above) and equalising income between spouses wherever possible to minimise the clawback. Of course if one partner’s income is significantly greater than £80,000 it will be very hard to avoid this charge and serious consideration should be made to making the election to not receive child benefit and remove the hassle of having to file a tax return and repay it all later. By April 2026, the Government is aiming for the charge to be administered on a household basis rather than an individual basis.

Important levels of income

Take note of the following levels of income:

Level of income in 2025/26 | |

| £12,570 | This is the basic tax-free personal allowance. Above this income tax is payable at the Basic Rate of 20% |

| £50,270 £60,000 | The level of income at which the Higher Rate of 40% applies The level at which Child Benefit begins to be clawed back |

| £80,000 | Child Benefit is completely reclaimed |

| £100,000 | Above this level of income the Personal Allowance begins to be reduced resulting in a 60% marginal tax rate; entitlement to the tax free Childcare Scheme is lost |

| £125,140 | At this point the entire Personal Allowance is lost. The level of income at which the Additional Higher Rate of 45% applies |

| £200,000 | The level at which reduction of pensions annual allowance needs to be considered |

| £260,000 | Income plus pension input – the level at which pensions annual allowance starts to get reduced |

| £360,000 | Income plus pension input – the level at which the pensions annual allowance is reduced to the minimum figure of £10,000 |

Gift Aid

We have mentioned that charitable donations are taken into account when considering net adjusted income, this is due to the “Gift Aid” scheme introduced by the government to encourage charitable giving. Essentially any qualifying Gift Aid payments are said to be made net of 20% basic rate tax. So if a taxpayer gives a charity £800, the charity can actually also claim back £200 from HMRC i.e. the charity receives £1,000. The taxpayer has received 20% tax relief at source because effectively they gave the charity £1,000 but only actually paid £800 themselves.

Higher rate and additional rate taxpayers actually get further relief on their charitable donations by extending the basic rate and higher rate limits. In our example above, if the doctor is a higher rate taxpayer, their basic rate limit is increased by the total value of the Gift Aid Donation. As you will know, the basic rate band is £37,700 – for this doctor it will be £37,700 + £1,000 i.e. £38,700. In this way the taxpayer will be paying tax at 20% on that £1,000 rather than 40%. So, for an £800 donation to a charity, the charity gets £1,000 and the taxpayer saves £200 from their tax bill (£1,000 taxed at 20% instead of 40%).

For additional rate taxpayers both the basic rate and the higher rate limits are extended by the gross amount of the gift aid payment. These taxpayers will receive an extra 25% relief on their gross Gift Aid payment.

It is the gross Gift Aid payment that affects the net adjusted income that we have been discussing in this chapter. Net income is reduced by the donation x 100/80 to arrive at adjusted net income. If my net income was £102,000 and I made a donation of £1,600 my adjusted net income would be £102,000 less (£1,600 x 100/80 = £2,000) i.e. £100,000.

A Final Thought

We have talked about marginal rates for doctors and areas where this will differ from the absolute rates. Note that things can be even worse for our patients who have low salaries and claim Universal Credit. As Universal Credit claimants earn extra money, the Government begin to take away their Universal Credit – the so called “taper”. If you have a patient earning £13,400 and they earn an extra pound, they will only take home 31 pence after tax, National Insurance and the reduction in benefits!

Join 30,000 doctors and receive free, exclusive, financial CPD for doctors in your inbox.

Medics’ Money is run by doctors and finance experts, for doctors. Our free financial CPD gives you all the knowledge you need to take control of your finances.